US$ et dette

De : https://sashalatypova.substack.com/p/the-story-of-us-debt?

Traduction automatique ici : https://tinyurl.com/yckj7dvs

On US Dollar and Debt

Plandemic start as as effort to stave off dollar's sunset

I am often asked about the reasons for the “Plandemic”. While I don’t know the complete answer, based on what I know today, in part it is related to the inevitability of the collapse of the US dollar as global reserve currency, and Plandemic being used as a (probably imminently failing) attempt at maintaining this status.

That’s the Venezuelan currency. Venezuela uses “direct” monetary system. The Soviet Union also did. Imagine this, but in electronic tokens and you will get an idea of what “Fed Now => subsequent transition to CBDC” approximately means. Your “money” (i.e. government permits) - worthless, the money the overlords hold - very powerful.

History of US Debt

The US debt is the total amount of money that the federal government owes to its creditors, both domestic and foreign. The US debt has been growing steadily over time, but it has became a tsunami in the past three decades.

Recessions Driving Debt

In recent times, one of the main drivers of the US debt growth was the economic recession that started in 2007 and lasted until 2009. The recession was triggered by a housing bubble that burst, leading to a financial crisis and a collapse of consumer spending and business investment. To stimulate the economy and prevent a deeper downturn, the federal government enacted several fiscal policies, such as tax cuts, spending increases, and bailouts. These policies increased the budget deficit, which is the difference between government revenues and expenditures in a given year. The budget deficit adds to the national debt each year. In 2007, the US debt stood at around $9 trillion and by 2010 the debt had increased to about $14 trillion or an increase approaching 50%.

Military Spending Driving Debt

Another factor that contributed to the US debt growth was the increase in military spending. The official narrative is that numerous enemies are plotting a variety of attacks on the US, and this has escalated after September 11, 2001. The truth is the US deep state has been constantly creating “inside jobs” - perceptions of imminent foreign threats to justify boogeyman stories for the public and excuses for the Congress to give them blank checks for redacted state-of-the-art prototype things for which bleep is accounted for. The DOD “lost” and can’t find 10x more money than it is allowed to spend. And this is only what they admit to. You can imagine the rest.

The US launched wars in Afghanistan and Iraq as part of its War on Terror campaign, which required substantial resources and personnel. According to one estimate, these wars cost $6.4 trillion between fiscal years 2001 and 2020, including increases to the Department of Defense and Veterans Administration budgets.

Reduction in Tax Collections Driving Debt

A third factor that influenced the US debt growth was the enactment of major tax reforms under different administrations. In 2001, the US debt stood at only at about $6 trillion (vs. $28 trillion today). In 2001 and 2003, President George W. Bush signed into law two sets of tax cuts that reduced income tax rates for individuals and corporations, as well as taxes on dividends and capital gains. These tax cuts were intended to boost economic growth by increasing incentives for work and investment, but they also reduced government revenues by an estimated $2.8 trillion over ten years. In 2017, President Donald Trump signed into law another tax reform that lowered income tax rates for most taxpayers, doubled the standard deduction, eliminated some deductions and exemptions, reduced corporate tax rate from 35% to 21%, and changed how foreign profits are taxed. This tax reform was expected to increase economic growth by encouraging business expansion and repatriation of overseas earnings, but it also reduced government revenues by an estimated $1.5 trillion over ten years.

Seeing that they steal our money no matter what for more false flags biosecurity, more bioweapons vaccines, and more psyops trusted media partnerships, and plain old Satanism

equity, diversity and inclusion, I think this particular category of

deficit is not a bad thing and should be encouraged. I don’t know about

you, but I am sick of funding my own enslavement with my own taxes.

Lack of Management of Government Expenses

Ultimately the debt is a function of government expenses outpacing tax collections. The US government has had no appetite to manage costs requisite to keep the overall debt in check. The U.S. government spending for 2022 was divided into three main categories: mandatory spending, discretionary spending, and interest on debt. Mandatory spending includes programs such as Social Security, Medicare, Medicaid, and other entitlements (yes, “entitlements”, deal with it) that are required by law. Discretionary spending includes programs that are subject to annual appropriations by Congress, such as defense, education, transportation, and research. Interest on debt is the amount of money that the government pays to service its outstanding debt.

The table below shows the amount of money allocated to each category in 2022:

Category Amount (in billions of dollars) Percentage of total spending

Mandatory spending 3,074 49%

Discretionary spending 1,688 27%

Interest on debt 514 8%

Total spending 6,276 100%

When we contrast this with tax collections, we see that there is a significant gap. The U.S. government collected $4.90 trillion in taxes in 2022 vs total spending of $6.28 trillion. This leaves a gap of well over $1 trillion per year. Plus $8 trillion that the DOD/Intelligence spends “off the books” and never have to account for.

US Debt Reaching Unsustainable Levels

By 2019, the US debt had reached $22 trillion of which around $17 trillion was held by the US public. In comparison, the total US GDP in 2019 was $21 trillion. As a result, total US debt exceeded total US GDP (i.e., debt was over 100% of GDP). Generally, rates of 70% and above are considered unsupportable.

The Treat to the US Dollar from Unsustainable Debt Levels.

When US national debt reaches unsupportable levels there is a risk that the US dollar may lose its reserve currency status.

The US dollar losing the reserve currency status could pose several risks to the national security establishment of the US. Some of these risks are:

Reduced global influence and leverage: By “leverage” I mean their ability to hold the gun to the head of most foreign governments, and certainly every node of power domestically. Something like this:

The US dollar’s reserve currency status gives the US “leverage” in international affairs, as it can use its economic power to impose sanctions, negotiate trade deals, and finance military operations by essentially creating money out of nothing any time they want to. If the US dollar loses its dominance, this awesome power will likewise evaporate.

Increased borrowing costs and debt burden: The US dollar’s reserve currency status allows the US government to borrow cheaply from foreign investors who are willing to hold US debt as a safe haven asset. If the demand for US debt declines, the US government may face higher interest rates and lower credit ratings, making it more difficult and expensive to finance its spending needs and service its existing debt. This could limit the fiscal space for future spending on defense, infrastructure, education, health care, social programs, scams, boondoggles, running every criminal network in the world, and many other leverage mechanisms.

Reduced purchasing power and living standards: The US dollar’s reserve currency status enables the US consumers and businesses to import goods and services at lower prices than they would otherwise pay. If the value of the dollar falls relative to other currencies, imports would become more expensive and inflation would rise. This could erode the purchasing power and living standards of Americans. It could also affect the competitiveness of US exports and hurt domestic industries that rely on imported inputs.

Increased vulnerability to external shocks: The US dollar’s reserve currency status insulates the US economy from external shocks, such as financial crises, geopolitical conflicts, or natural disasters. If the US dollar loses its status as a global safe haven, the US economy may become more exposed and vulnerable to these shocks, which could trigger capital flight, market volatility, and economic downturns.

In summary, it seems all US power, prestige, and shiny image actually is somehow related to the dollar’s status as the global reserve currency.

Government Out of Options to Stimulate Economy

In 2019 interest rates were at historical lows and central bankers were struggling to think of ways to stimulate the economy to strengthen the currency.

The low interest rate and low growth environment that existed in 2019 was a source of concern for central bankers as there were no clear ways to stimulate the economy. Some of these concerns are:

Limited monetary policy effectiveness: Central banks typically lower interest rates to boost economic activity by making borrowing cheaper and encouraging spending and investment. However, when interest rates are already very low or even negative, further cuts may have little or no impact on demand, as consumers and businesses may be reluctant to borrow due to uncertainty, debt overhang, or regulatory constraints. Moreover, low interest rates may also have adverse effects on financial stability, such as creating asset bubbles, encouraging excessive risk-taking, eroding bank profitability, and reducing market liquidity.

Lack of fiscal policy coordination: Fiscal policy refers to government spending and taxation decisions that affect the level and composition of aggregate demand. Fiscal policy can complement monetary policy by providing stimulus when interest rates are near zero or by reducing deficits when inflation is high. However, fiscal policy coordination among different countries or regions may be difficult due to political disagreements, institutional constraints, or divergent economic conditions. For example, in the eurozone, some countries such as Germany had fiscal surpluses and low debt levels but were reluctant to increase spending or cut taxes to support growth. Other countries such as Italy had fiscal deficits and high debt levels but faced pressure from the European Commission to reduce spending or raise taxes to comply with fiscal rules.

Going Direct

In the central bank circles, the only viable strategy that arose was the concept of going ‘direct’ to stimulate the economy to strengthen the dollar as well as increasing inflation to reduce the effect of the debt burden. However, there were significant political hurdles to being able to implement the policy without a ‘crisis’.

The concept of ‘going direct’ was proposed by a group of former central bankers and BlackRock executives in a paper published in August 2019. The paper suggested that when conventional monetary policy tools such as interest rate cuts and quantitative easing are insufficient or ineffective, central banks can coordinate with fiscal authorities to provide direct stimulus to households and businesses. This could involve creating a monetary-financed fiscal facility that would bypass the financial system and inject money directly into the real economy. Some examples of ‘going direct’ could be helicopter money (direct cash transfers to citizens), targeted tax cuts or spending increases, or public investment programs.

The paper argued that ‘going direct’ would be more powerful and efficient than conventional policies, as it would avoid the transmission frictions and financial stability risks associated with relying on banks and financial markets. It also claimed that ‘going direct’ would not undermine central bank independence or fiscal discipline, as long as there was a clear framework and governance structure for policy coordination.

Why a “Plandemic” Was a Convenient Method to Prop Up Failing US Currency in the Global Context

As previously described, the US was piling on debt that was becoming unsustainable for the economy as well as for the reserve currency status of the US dollar. Traditional measures of stimulating the economy, such as interest rate decreases, were no longer possible as interest rates had already hit rock bottom by 2019. At this point, clever central bankers and Blackrock had determined that going ‘direct’ to stimulate the economy, strengthen the dollar, and increase inflation to reduce the debt burden were the only solution to all of their problems. However, some external event was needed in order to be able to justify these unusual steps.

As the pandemic was declared, the US went all-in on the going ‘direct’ approach. Some of the specific steps that the US government took during the Covid-19 pandemic that could be considered ‘going direct’ were:

Economic Impact Payments (EIPs): These were direct cash transfers to eligible individuals and families, authorized by three rounds of legislation in 2020 and 2021. The total amount of EIPs distributed was $931 billion, benefiting around 165 million Americans.

Advance Child Tax Credit (CTC) payments: These were monthly payments of half of the expected CTC for eligible families with children, authorized by the American Rescue Plan Act of 2021. The total amount of advance CTC payments distributed from July to December 2021 was $105 billion, benefiting about 84% of children in the US23.

Corporate Credit Facilities: These were programs managed by the Federal Reserve and BlackRock to purchase corporate bonds and lend directly to businesses affected by the pandemic. The total amount of corporate credit facilities outstanding as of December 2021 was $13.6 billion.

These steps could be seen as examples of ‘going direct’ because they involved creating or expanding monetary-financed fiscal facilities that bypassed the financial system and injected money directly into the real economy.

Plandemic Temporarily Restored the Value of US Dollar, but the Gains are Quickly Evaporating

The

US Dollar Index was trading around 96 at the end of 2019. In March of

2023, the dollar index traded at around 121. This would indicate that

the value of the US dollar had increased by around 25%. Clearly the

plan of manipulating strengthen the US dollar worked for the time being. It remains to be seen for how long.

Additionally, inflation had reduced the value of the outstanding US debt. Between 2019 and 2023, the official rate on inflation according to consumer price index was approximately 20%. However, there have been concerns that the official CPI rate dramatically underestimates the rate of inflation. For example, ShadowStats Alternate CPI, which uses a stable basket of goods (unlike the CPI), estimates that inflation during this time period was approximate 60%. In 2023, the national debt was around $28 trillion. However, when taking into account the effect of inflation, the national debt would have been effectively reduced by approximately $17 trillion.

Net-net, US dollar was temporarily strengthened, reserve currency status was maintained and the effect of the US dollar debt was reduced by 60% or approximately $17 trillion.

Gains from Plandemic and Lockdowns Were Temporary and are Unraveling Now Anyway:

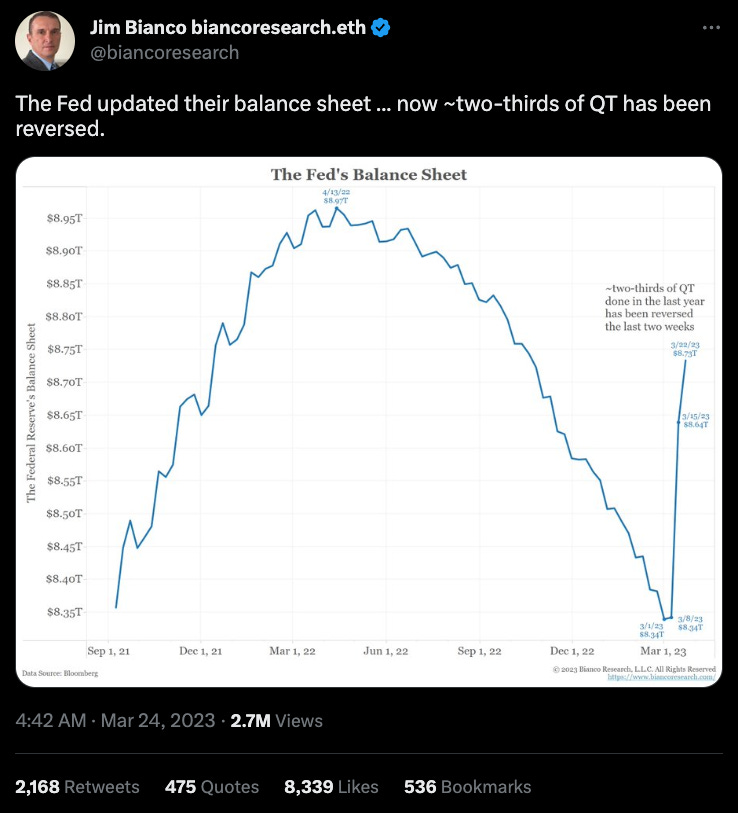

On March 10, a bank with $200B in assets went to zero[1] overnight. Since then, we’ve seen the following things happen: Emergency Sunday Fed print for domestic banks [2] $2T estimate of amount to be printed [3] $18T estimate of amount to back all deposits [4] 186 banks reported similarly insolvent[5] $500B wired from banks, seeking safe havens [6] $150B+ in discount window, more than 2008 [7] ~$400B printed in days, reversing most QT [8] Emergency Sunday Fed print for foreign banks [9] Joint Sunday statement: US banks are “resilient" [10] 5 dead banks, incl too-big-to-fail Credit Suisse [11] Rumbles around Deutsche Bank[12] Rumbles around Charles Schwab [13] Emergency Friday meeting of Yellen and FSOC[14] Another statement that US banks are "resilient”[15] Statement: "further actions may be necessary"[16] All this comes against a backdrop of articles and charts from the Fed and FDIC talking in coded language about how many US banks are insolvent due to $620B+ in unrealized losses caused by the Fed’s surprise rate hikes.[17]. Despite this growing concern, the banking crisis seems to not have broken out of financial news. Arguably, it is intentionally being downplayed outside of the space where it can't be ignored. For example, I haven't seen too many White House tweets on the banking crisis, but I have seen them meeting Ted Lasso[18]. Perhaps they simply don't want to "panic" anyone by telling them their bank may have a problem. But let’s be clear. This is a Western banking crisis. This is not normal. This isn't anyone's hallucination. And reporting on it isn't the same as causing it.

[1]: https://archive.is/3enQM [2]: https://archive.is/qrZYB [3]: https://archive.is/rnfWU [4]: https://archive.is/goeud [5]: https://archive.is/MTGuh [6]: https://archive.is/wip/nESzf [7]: https://archive.is/4sYty [8]: https://archive.is/Ta5fo [9]: https://archive.is/GPGJ8 [10]: https://archive.is/ahpbI

Clearly, it can be argued that the Plandemic was very convenient for the central banks and it was also convenient for the US dollar. Temporarily. The prop-up effort did not prevent the rise of the yuan-ruble alliance, and, gasp (!) major wars being stopped by Chinese diplomacy. That’s a blow for war mongers and their revenue sources.

Is this why the plandemic happened and is this all there is to it?

Maybe. It may have started with cooperation of the parties who THOUGHT that this was the whole plan. The finance crowd. Maybe they were sold the idea that this was the way to prop the house of cards that the US dollar has become.

If the reasons for global Plandemic were purely finance driven, the mass killing of the population is much harder to explain. While one could believe that the planners of the Plandemic would not bat an eye at killing off the elderly and the retirees to improve the balance sheet (it does help with the debt due to entitlement spending), the killing and injuring of the younger population and especially children is much harder to fit into this scheme. Children are net consumers for about 20 years, and help the economic inflation. The deflation was happening because there were too few children being born to begin with. So why kill, injure and sterilize them if the whole plan was to increase the inflation? This doesn’t make sense.

A possible explanation I can think of is that the Plandemic might not be a single plan/strategy by a unified group. There are probably 2-3 strategies being played. For instance, a group that has scenario #2 in the pocket, plays along with the group that has scenario #1 enough to start it, then introduces their own play as it unfolds.

The finance/central banks crowd was sold the “propping of the dollar” scenario, and once they went along and started it, the additional scenarios were piggy backed on it, by the groups who do not want the global dollar. Yes, that could be China and Russia - obvious suspects since now we see yuan being used to settle oil purchases. That’s a biggie. So was it the Chinese “gift” to wipe out Western populations in an attempt to stay competitive since their own population was crashing faster than the West? Demography is destiny after all.

I personally do not think this decision was necessarily driven from China, even if in this case China looks like a beneficiary of it. They did stupid things like “zero-covid” policies. And they militantly vaccinate all of their population with all kinds of toxic brews, which may explain, for example, why all of their young people are going blind with myopia progression raging at 95% now. That seems to indicate that they were not doing any of this as a coherent strategy.

Finally, I advise everyone to NOT think too much along national borders, because whoever is driving the attack on the world does not think that way. The “owners” of the world (self appointed) think that all of it belongs to them, they control the nations and fund all sides of wars. Enough activity happens along the nation-state lines so it appears like geo-politics. And on the tactical level this may be true. The strategy, however, often comes from the groups that are not beholden to the nations. They are “sovereign” themselves, and these include not only central banking but also various private organizations. And yes, that includes Bill and Melinda Gates Foundation. The cascade may go like this: start dollar-propping play with the help of the finance morons who fly to Jackson Hole and hire the US DOD for the job by organizing the thing as a war response, then proceed to mass poisoning, including the Jackson Hole crowd themselves.

This seems like it is driven from above-nation level, especially in the astoundingly uniform self-harming policies being played by nearly every government in the world. That kind of coordination around mind-numbingly stupid activities, for years? Doing the opposite of what most public health policies stated in years prior, all together, in unison? Counting the bodies of citizens, including women and children for years and calling it “safe and effective”? Hard to imagine that it is a spontaneous cooperation, and simply because of “the novel virus”.

Art for today: Sketch of Death Valley, oil on panel 6x12 in

Commentaires

Enregistrer un commentaire